CEO turnover in Australia sits at 21.9% and is higher than most other mature economies1. While there are many contributing factors, including behavioural and ethical concerns, conflicts with the board lead to the end of more than one in ten CEO’s tenure. Poor communication of the board’s expectations is often at the root of this conflict. One of major governance roles of the board is CEO recruitment, performance and succession planning and this article examines how boards should approach CEO assessment.

The value of CEO assessment

CEO turnover is costly in terms of the instability it creates within the organisation along with any termination payments and costs associated with hiring a new CEO. Boards have solid business reasons for undertaking CEO evaluations including:

- aligning the strategic direction set by the board with the CEO’s capabilities;

- promoting better board and CEO relations to ensure an appropriate and productive collaboration;

- allowing boards to have greater objectivity about CEO remuneration;

- setting an example of accountability for the organisation as a whole – signalling that performance management is a core culture of the organisation;

- encouraging the CEO’s personal development;

- providing an early warning system for possible problems2.

The Evaluation cycle

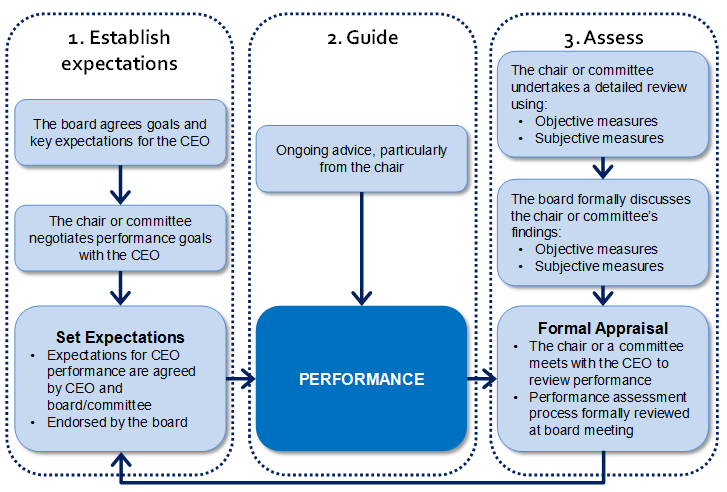

As indicated in Figure 1, CEO evaluation is part of a continuous cycle of:

- establishing performance expectations;

- guiding performance; and

- assessing performance.

Figure 1: Generic CEO evaluation cycle3

1. Establishing expectations

Clear expectations form the basis for all good performance relationships. While boards should feel free to develop their own categorisation of expectations, a holistic evaluation of the CEO’s performance will generally include some targets or expectations with respect to the following:

- leadership and management;

- strategy;

- working with the board;

- financial performance;

- human resource management;

- personal qualities; and

- communication.

Categorisation provides the board with the opportunity to assess the balance of its measures. Are there enough lead indicators to ensure the board will be able to spot problems as they emerge rather than after they happen? Do the targets balance organisational and personal outcomes for the CEO? And very importantly, do they match the board’s objectives for the evaluation process and for the organisation’s strategic direction?

A key problem that emerges throughout the discussion of goals is setting an appropriate number of objectives for the CEO. Too few and you risk concentrating on financial goals or one element of the business; too many and you risk the CEO and management team losing focus. Our experience is that between 5 and 10 key objectives is an appropriate balance.

These key objectives should include both financial and non-financial indicators, since financial indicators tell only part of the CEO’s performance ‘story’ and are often lagging indicators of effective performance.

The success of the CEO evaluation process will also depend on setting high but achievable objectives within the agreed areas. As far as possible, expectations and measures should be clear to all parties. A simple technique to ensure clarity is to insist that expectations be ‘SMART’. Expectations should be specific (i.e., closely defined), measurable (even if it is a subjective assessment), agreed (between the CEO and those involved in the evaluation process), realistic (i.e., they are not an impossible stretch) and should specify timeliness for their achievement and measurement. This does not mean, however, that all expectations/goals should be quantitative and/or objective, particularly in the not-for-profit or public sector. Boards have a number of choices when developing each measure: will the measure be objective or subjective; and will the measure be quantitative (expressed in numbers) or qualitative (expressed in words)?

2. Guiding and assessing performance

Meeting expectations, particularly those of the board, remains one of the persistent challenges for many CEOs. Therefore, once the board and CEO have discussed and set the board’s expectations for CEO’s performance, ongoing communication is critical. At regular intervals, data can be collected to inform the board on the CEO’s progress against these objectives. If the board, preferably through the chair, provides feedback to the CEO on their performance on an ongoing basis, the CEO will be able to correct any performance issues as they arise. For example, the board may suggest coaching or mentoring for a new CEO, if aspects of their leadership are found wanting. Also critical are touch points for formal milestones. Formal, annual goal setting and feedback sessions, for example, should be supported by additional formal, semi-annual feedback.

3. CEO evaluation process

An effective CEO evaluation process aligns performance expectations with the strategy of the organisation. This is more likely to occur if the CEO evaluation process is integrated with the board’s strategic planning cycle. It is easier to establish meaningful goals for the CEO’s performance when they are considered in the context of goals set for overall corporate performance.

One way of ensuring that strategic planning and the CEO evaluation process are in alignment is to develop board processes that reinforce the relationship. For example, the board calendar is a useful tool for ensuring the two planning processes are aligned. As soon as the strategic plan is agreed, work begins on the development of the CEO evaluation plan. The calendar is also useful for ensuring that the board provides regular feedback to the CEO on their performance so that, by the time the official performance evaluation arrives, there will be no surprises.

The feedback loop drives improvement

The CEO feedback process belongs to the entire board, and all should be involved. It is not a chair’s or a committee’s responsibility. One of the primary inhibitors of candid feedback on performance is the emotional element of these processes which can be addressed via a system which allows for a less formal and more considered approach to providing the feedback. However, a process or procedure is no substitute for a good working relationship between the board and the CEO.

Effective Governance is experienced in guiding boards through CEO performance reviews. If you wish to prepare for your CEO’s review or need assistance with structuring a clear process, contact us.

1 Australian Institute of Company Directors (AICD), 2019, Top 5 CEO turnover trends for boards, https://aicd.companydirectors.com.au/membership/membership-update/top-5-ceo-turnover-trends-for-boards, accessed 22 April 2022..